Future Developments

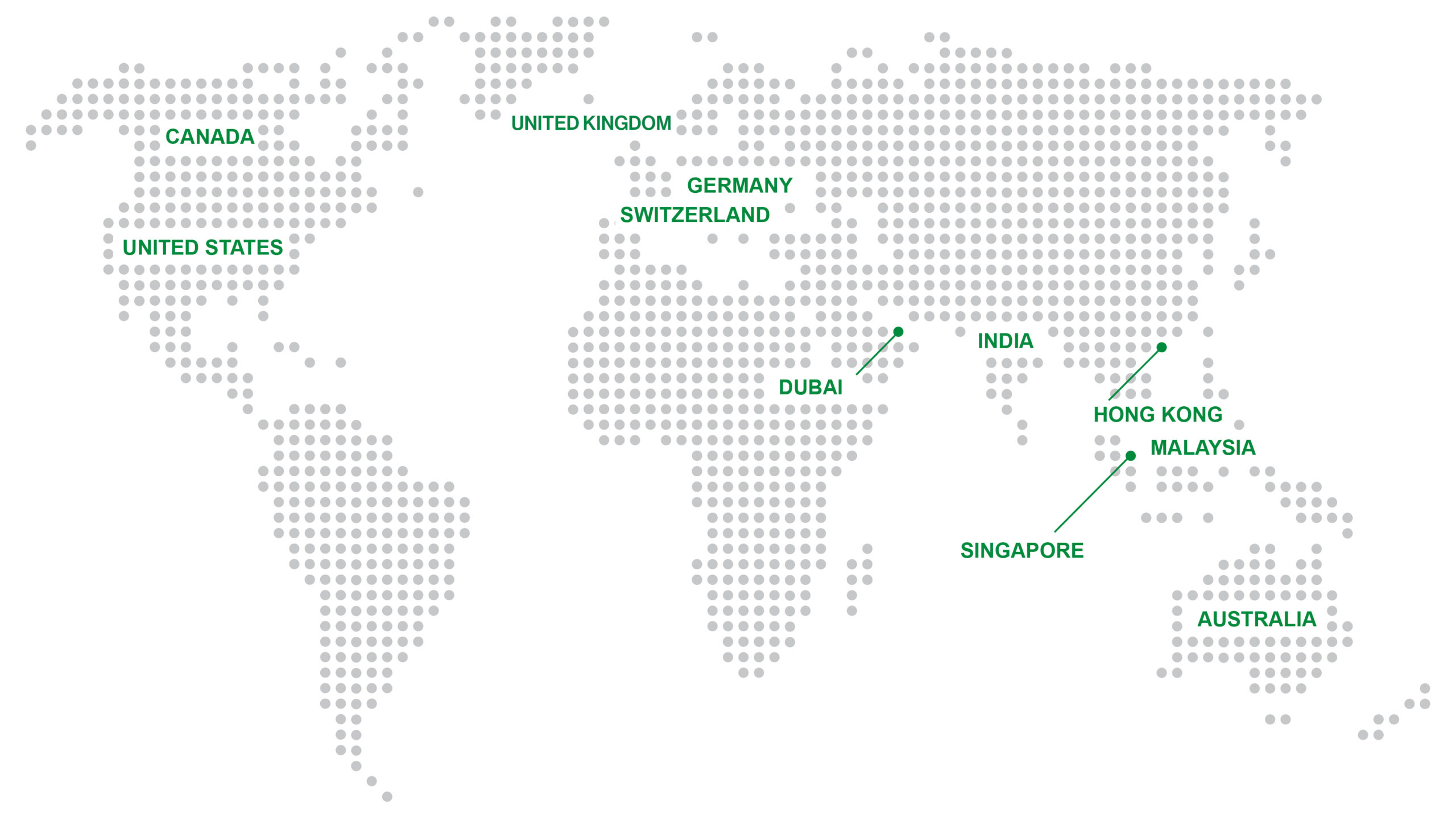

As markets develop and regulatory frameworks evolve, 360T clients can be assured that the Company remains actively engaged with regulatory and government authorities at all levels to ensure that not only does 360T have all necessary approvals required to provide its services, but also that 360T proactively seeks to lead the way in pressing for proportionate regulatory regimes that allow for the efficient and fair functioning of wholesale foreign exchange and OTC markets.

Should clients have any queries concerning the respective jurisdictions in which 360T operates, they may seek advice directly from 360T Regulatory: [email protected]